Machine Learning (ML) using Supervised Modelling & Cyclical Regression

collective sentiment & cycles

Trading the stock market is probably the hardest job in the world and as a result of that the most humbling experience one may ever have and yet again its rythms follow the aggregated sentiment of a collectivity. Is the stock market therefore really that random? What if we were to apply a set of mathematics and statistics alongside cyclical concepts? Or even better compute all that in real time across thousands of symbols and publish it in comprehensive and interacive dashboards with visual charts?cyclical regression

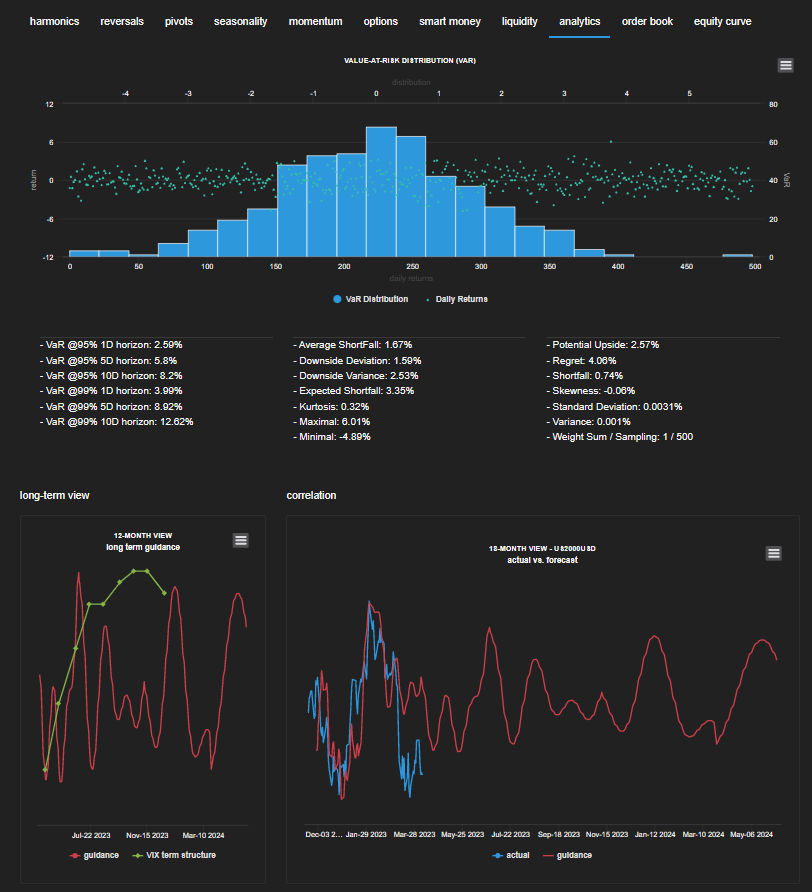

Cyclical regression analysis is a continuously evolving family of algorithms that provides the simultaneous estimation of all risk parameters of a repetitive oscillation model. We have spent 7+ years developing a cyclical regression model and platform that's able to track in real time more than 2700 instruments across an array of asset classes. Instead of leveraging existing libraries we have developed the algorithm from the ground up hence allowing for optimal performance and fine tuning as well over time. The Hedgtrade platform is a unique offering in that respect combining not only cyclical projections but also combining it with seasonal patterns, technical momentum and trend indicators, dark pool and order book data among many other data sets.machine learning (ML) for time & price projection

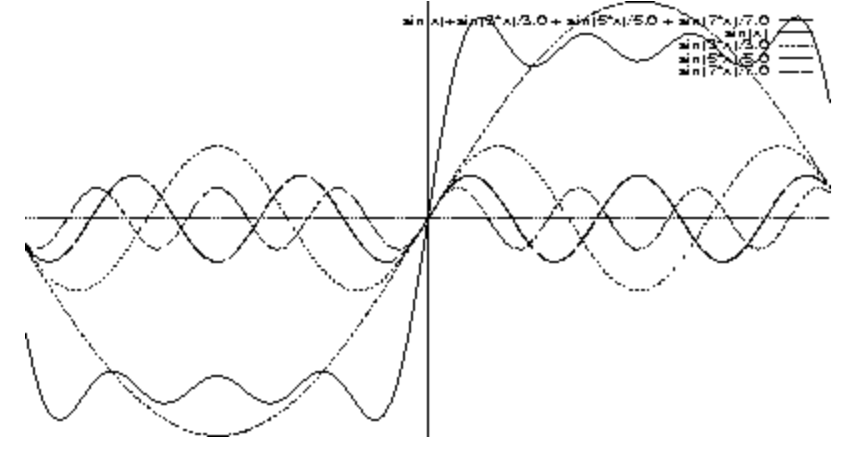

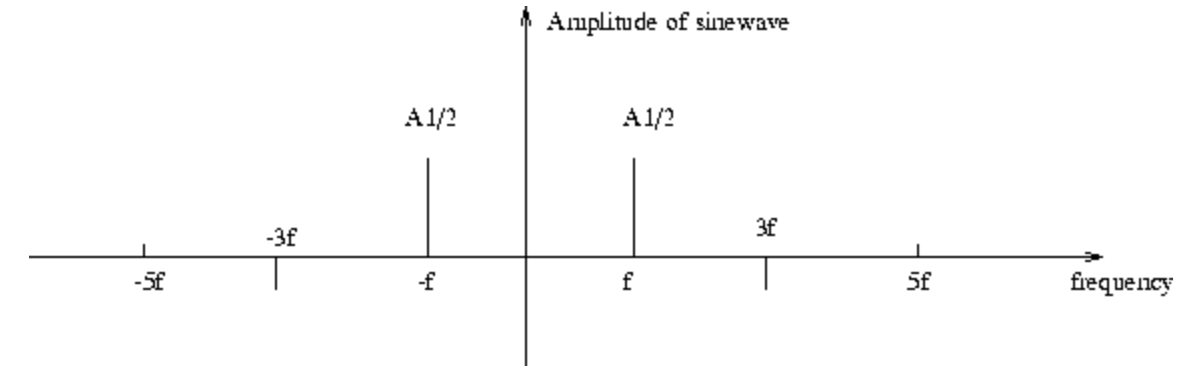

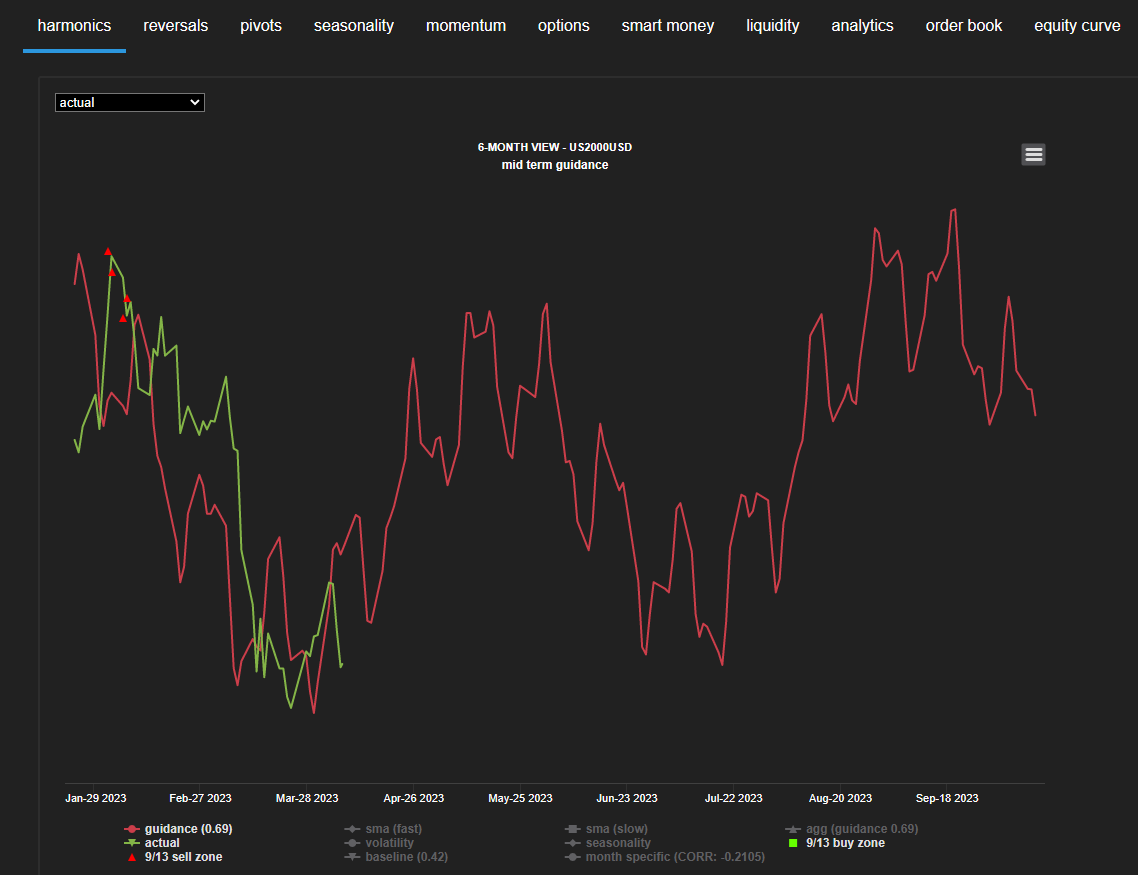

At a high level the computation of the cyclical regression starts with the idea similar to that of a Fourier transform which is a mathematical function that transforms a timeseries from the time domain to the frequency domain. This is a very powerful transformation which gives us the ability to understand the harmonics that are inside the underlying data. Complex signals made from the sum of sine waves are all around us and that includes stock market dataseries. In fact, all signals in the real world can be represented as the sum of sine waves, and this is where the marriage of cyclical regression along with the computation of the underlying dominant harmonics of any financial instrument starts to make sense in order to uncover alpha, but not yet and one still has to extend that matrix into a time projection. This is where the world of machine learning comes into play in order to generate and document projections across all kinds of timeframes, instruments, and asset classes.As an example of what the Fourier-like Hedgtrade transform model does, let's look at the two graphs below:

One of the key steps is to break down the market data series into its own underlying dominant oscillating components.

And to finally filter it by its most dominant harmonics in order to feed the machine learning projection model

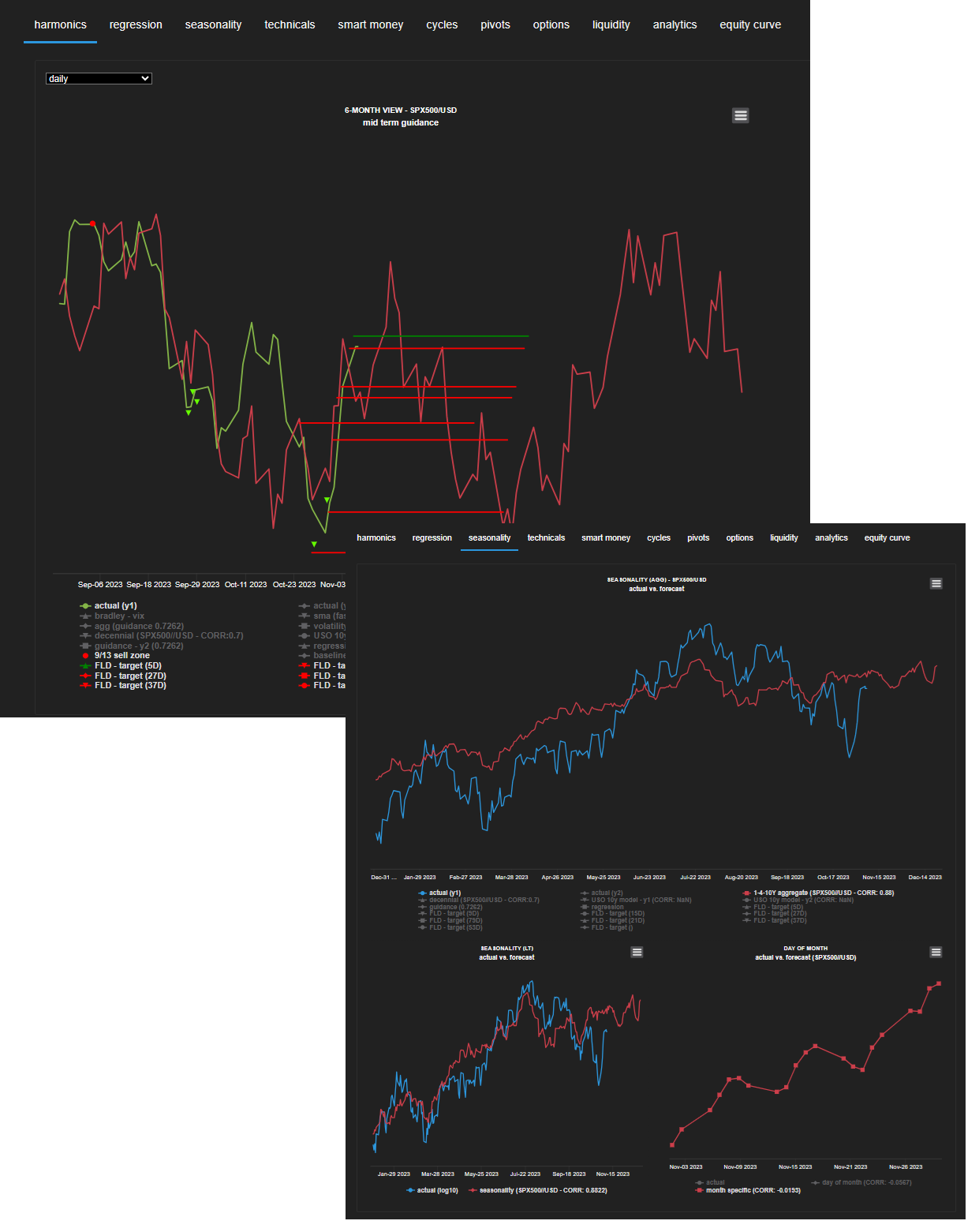

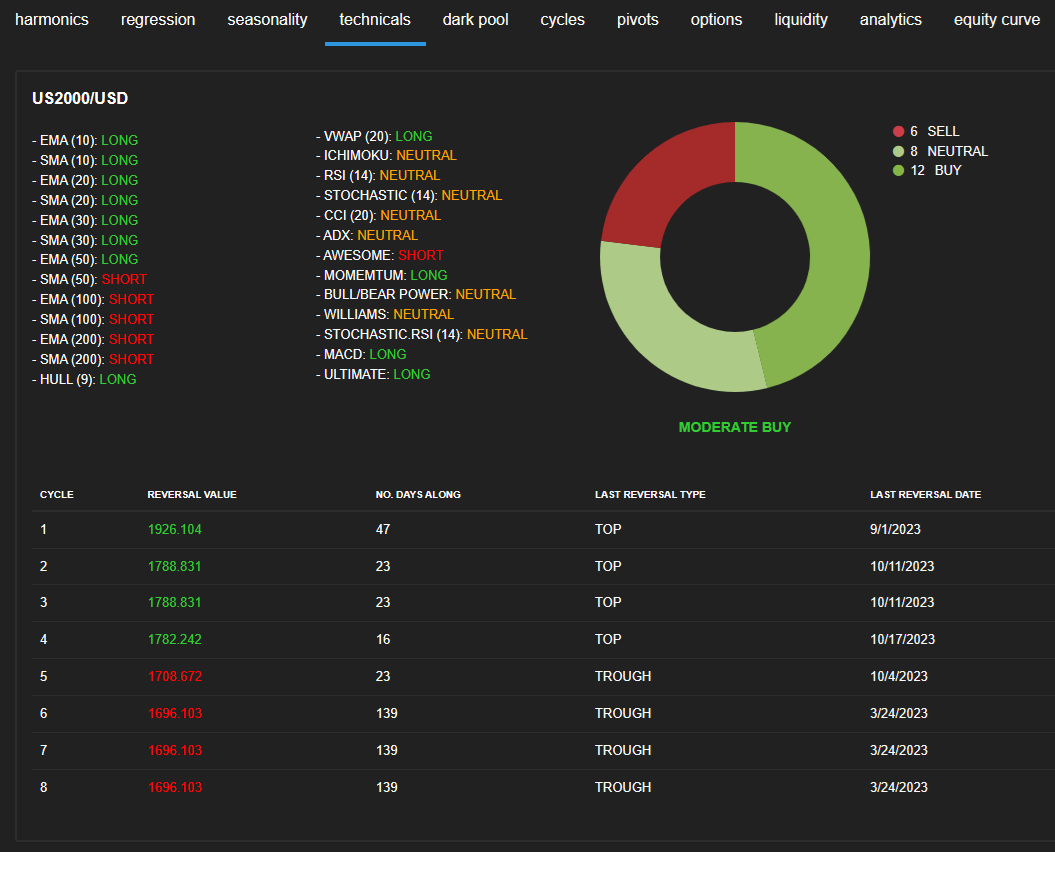

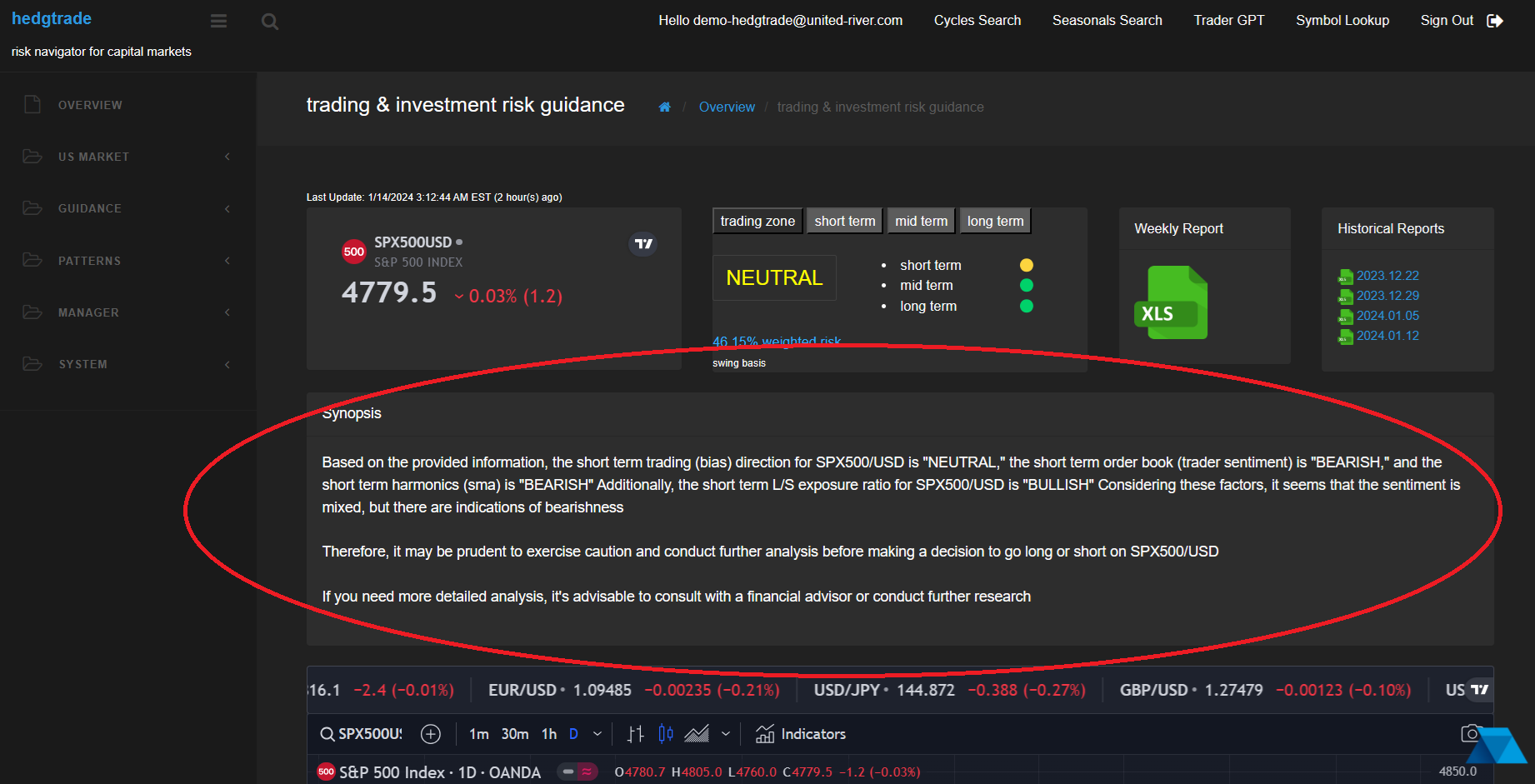

And the result of that is a projection into the future that correlates with the underlying matrix, given all things being equal and updated in real time by the quant platform - example below of a projection with the Russell 2000 going into the next couple of weeks along with the thought process that it's all about building the sum of the evidence from a statistical point of view along with Hedgtrade's supporting models including but not limited to seasonality (aggregated, decennial, election, day of month, etc), order book stats, liquidity models, technicals (momentum & trends), VIX projection, US dollar projection, and so on...

Among other data points, the regression model also offers points of reversals for placing T/Ps and S/Ls alongside its technical trends and momentum metrics hence supporting the overall thought process for the investor to build the sum of the evidence and have a statisitcal bias that's removed from any emotion or as some would call it FOMO among other reactions to market movements

Hedgtrade.com is not a registered investment advisor, please refer to our terms of service, and privacy policy for more information. Please note that by subscribing to our service you agree to those terms as well as the no indemnity clause.

Copyright 2024 Hedgtrade - All Rights Reserved

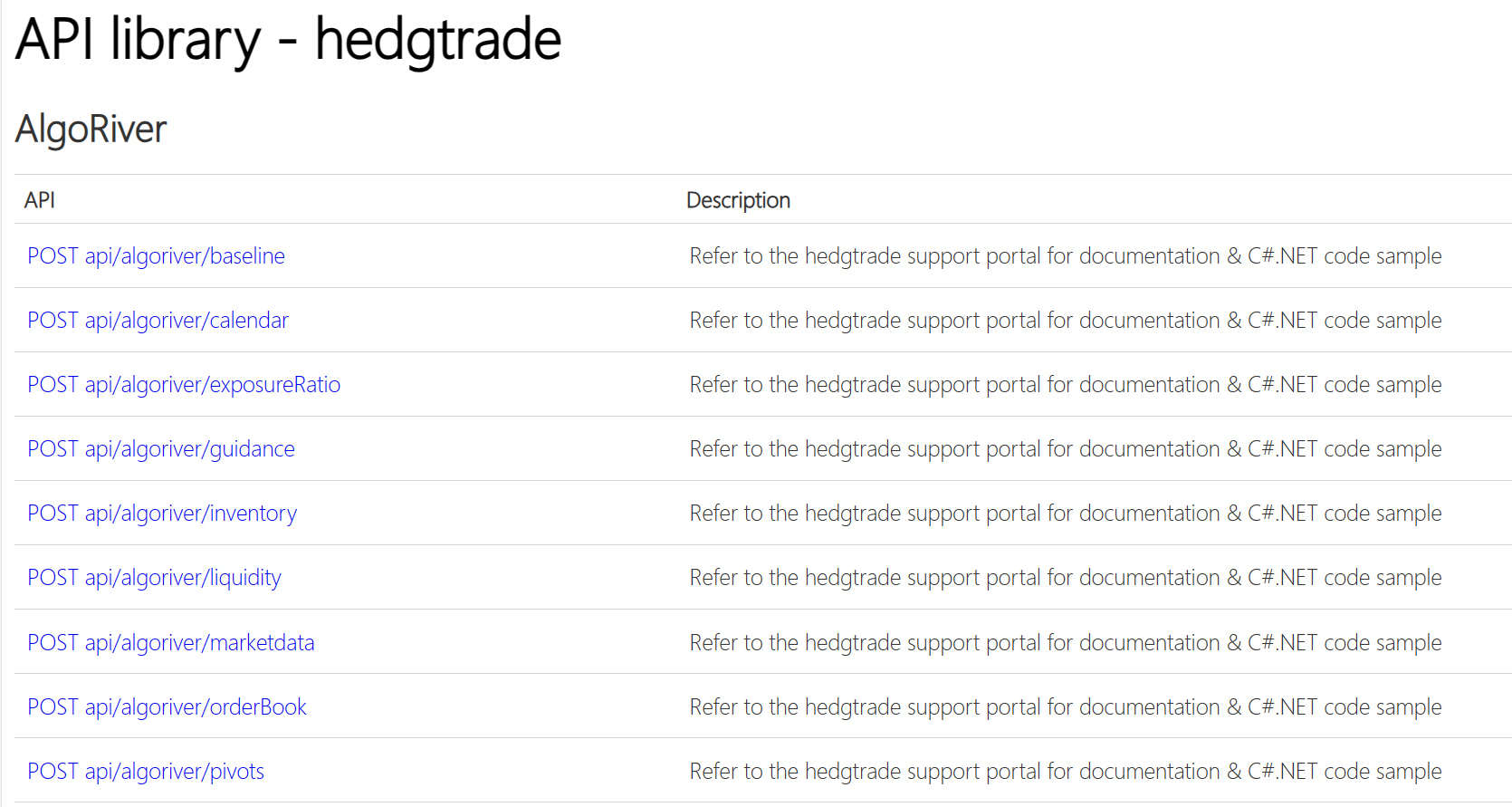

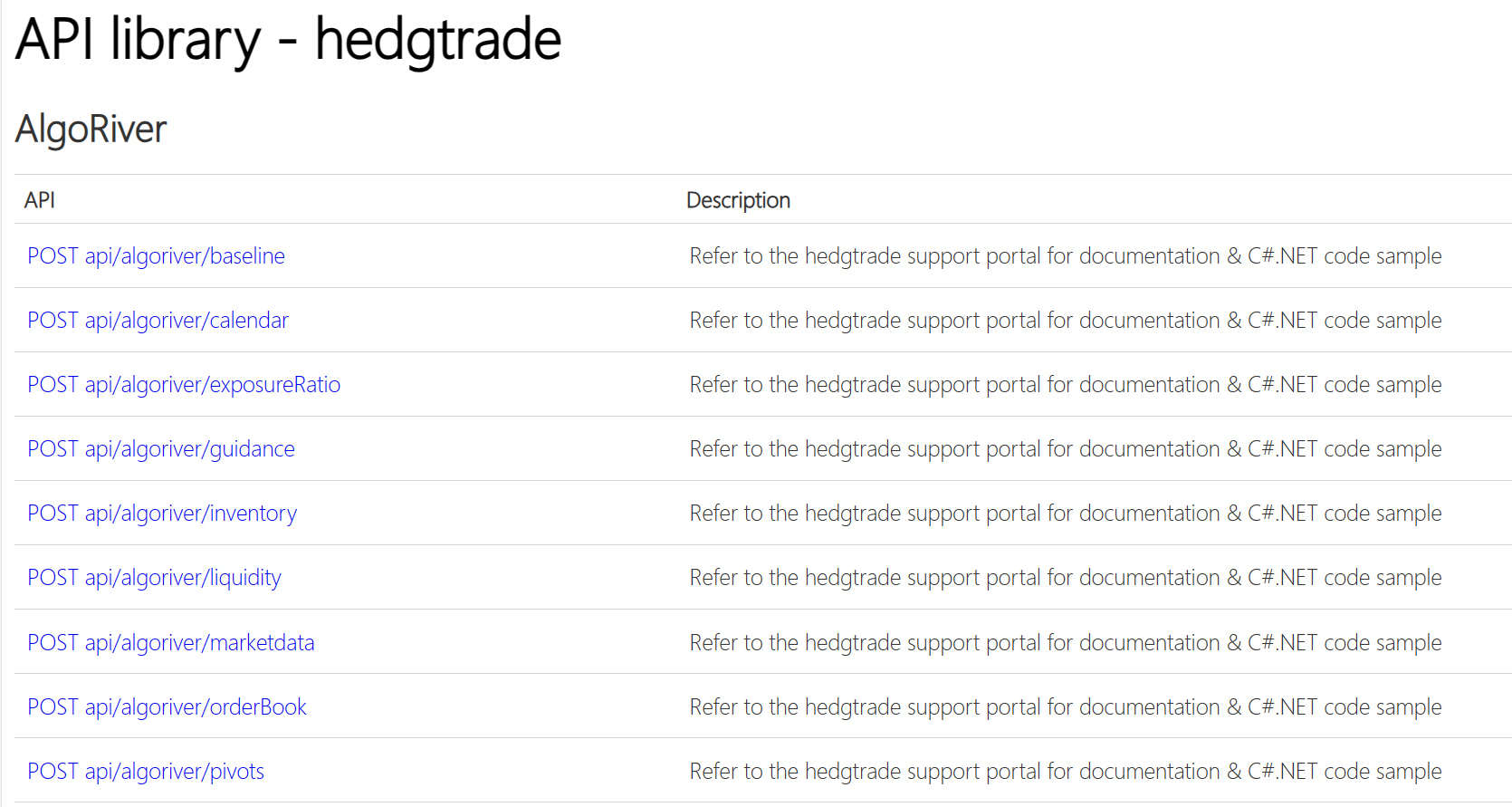

Full API Access for Institutional Investors

In addition to the comprehensive visual experience that the platform's dashboards offer to the end users on a day to day basis, the tech savvy

investors have also access to Hedgtrade's underlying data sets in real time.

Have an internal project ? Or looking at whitelabelling some reporting data ? Or maybe for publishing through your own solution or what have you?

Please reach out for any questions you may have and our team will be happy to assist.

https://api.united-river.com/help

Quantitative Strategies & Algorithms

In the dynamic world of financial markets, traders are constantly seeking an edge to outperform the competition and maximize returns. The reality is that there's no holy grail, that just does not exist. What is is possble however is the production of risk adjusted trading algorithms that perform over the test of time, as opposed to maximum return or curve fitting.

This broader pursuit is what has led to the development of various trading strategies by quant funds and others,

with quantitative trading emerging as a powerful approach fueled by data analysis, statisitical & mathematical models.

The Hedgtrade platform does have a set of trading strategies that follow the underlying risk factors of the reporting layer hence

bringing absolute full transparency, as opposed to another black box that churns out trading signals without knowing where they come from or

why they were enacted in the first place. The Hedgtrade platform bridges that gap with full reporting on each of the risk models used to compute

in real time those trading signals.

Hedgtrade's Algorithmic Trading Capability

Quantitative trading, also known as algorithmic trading or systematic trading, involves the use of mathematical models and statistical techniques to make trading decisions. Unlike traditional discretionary trading, where decisions are based on human intuition and subjective judgment, quantitative trading relies on objective data analysis and predefined rules.

At the core of the Hedgtrade platform are algorithms that analyze vast amounts of historical and real-time market data to identify trading opportunities and execute trades with precision and speed. The Hedgtrade algorithms range from simple to highly complex, incorporating various factors such as price movements, seasonality, cyclical patterns & harmonics, market counts, VWAP, order book and market sentiment among many others, in fact its more than 40 risk factors that are covered for each of the 2600+ instruments available in Hedgtrade.

Key Components of the Hedgtrade Quant Strategies

- Data Collection & Analysis

Quantitative trading begins with the collection & analysis of all of the underlying data sets. Hedgtrade does collect and maintain its historical price data, fundamental indicators, sentiments, and other market-related information (seasonality, options data, etc). Advanced techniques such as machine learning and natural language processing are also employed to extract foward looking insights from unstructured data sources (SEC, Federal Reserve, etc). - Strategy Development

Once the data is gathered and processed, the Hedgtrade platform updates its quantitative models that define when to enter or exit trades based on specific criteria. These models are an aggregation of technical analysis, statistical arbitrage, trend-following and mean reversions. Backtesting has been essential to evaluate the performance of the Hedgtrade strategies. - Risk Management

Effective risk management is critical in quantitative trading to protect capital and minimize losses. The Hedgtrade algo concept however is not to use hard stop losses and take profits but rather to have a dynamic position sizing algorithm that provides netting effect (long vs short for the same underlying position), and also the benefit of portfolio diversification that provides again dynamic risk adjustments based on market conditions. Risk management algorithms continuously monitor the portfolio's exposure and adjust positions accordingly to maintain those predefined risk parameters. - Execution & Broker Connectivity

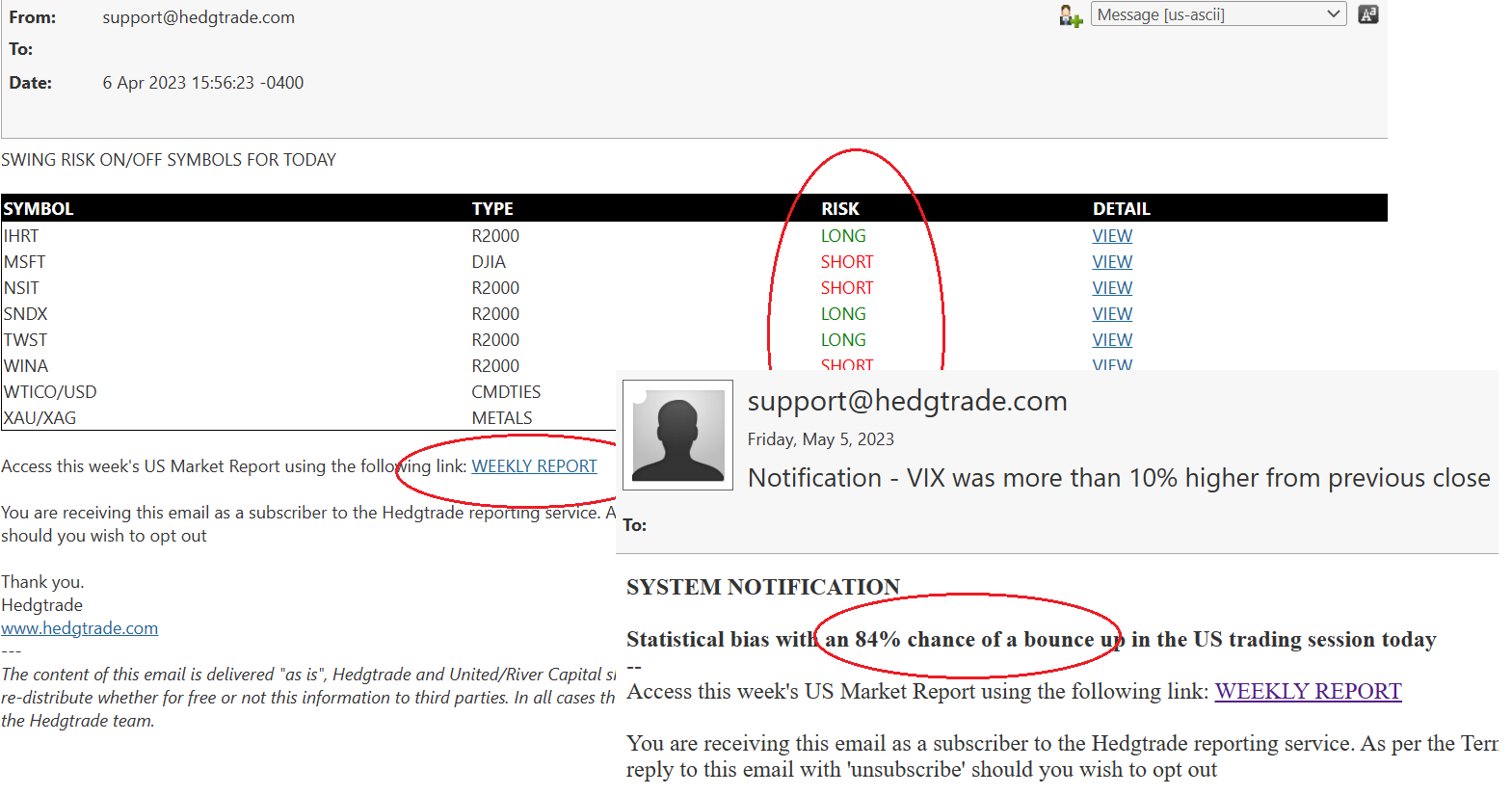

Hedgtrade does have a set of APIs for the more tech savvy investors that require automated conectivity to their broker-dealer. Hedgtrade does also provide email delivery of the trading signals.

Hedgtrade's Family of Quantitative Strategies

- Trading Zone Category

Using a set of of 40+ risk factors, mean reversion strategies exploit the tendency of asset prices to revert to their historical mean over time. These strategies involve buying & selling assets that have experienced significant price declines and selling assets that have appreciated excessively, anticipating a return to their average value. - Short Term Category

Trend-following strategies aim to capitalize on sustained price movements in the same direction. Hedgtrade identifies trends using technical indicators such as moving averages, VWAP, and trendlines, and accumulate long/short positions and will top up only in the direction of the trend, betting to ride and accumulate on momentum for profit and disregard the losing positions. - Mid Term Category

Index driven statistical arbitrage strategies that exploit pricing inefficiencies between related markets (US & Global indices). By identifying pairs of assets that have historically exhibited a strong correlation but have temporarily diverged in price, Hedgtrade can simultaneously buy the undervalued asset and sell the overvalued asset, expecting prices to converge back to their historical relationship. - Long Term Category

Macro models backed by machine learning techniques are increasingly being used to develop predictive models. These models analyze vast amounts of data to uncover complex patterns and relationships that may not be apparent to humans, providing a competitive edge in the market for long term investors.

Trading Automation with Hedgtrade

Quantitative trading offers traders a systematic approach to navigating the complexities of financial markets by leveraging data analytics,

mathematical models and automation. By leveraging the Hedgtrade technology, quant traders and investors are able to employ

effective trading strategies and gain a competitive edge that enhances their chances of success in today's fast-paced trading environment.

The Hedgtrade trading signals are no black box, all the models are supported by highly visual reporting dashboards as part

of the platform. All trading signals can be delivered via EMAIL or API (and we can also customize delivery by calling your own web services, etc)

Please reach out for any questions you may have and our team will be happy to assist.

https://api.united-river.com/help

Intraday Trading & Scalping

Step into the realm of precision trading with our state-of-the-art scalping system — a dynamic tool that combines cutting-edge time

projection and price projection functionalities with access to over 125 symbols across a diverse range of asset classes (forex, US & global indices, metals, commodities, US bonds, etc)

We've harnessed the power of time cycles and harmonics in the 10-15 minute timeframe to provide unparalleled accuracy in time projection.

By analyzing market rhythms and patterns, our platform delivers precise 'calls to action' that empower you to capitalize on fleeting opportunities

in real time.

Our scalping system goes beyond time projection to offer comprehensive price projection capabilities as well that include stop loss, take profit,

and reversal numbers. Whether you're looking to protect your capital, secure your profits, or anticipate market reversals,

our platform provides the tools you need to make informed trading decisions with confidence.

And when it comes to determining the short term long or short direction, our scalping system leverages the trading bias obtained from the daily timeframe

as well - a strategic approach that ensures you're always aligned with the prevailing market trends.

Here's why traders worldwide are choosing our scalping system:

1. Precision Timing: With time cycles & harmonics as your guiding principles, the platform offers unmatched precision in timing projections. Whether you're scalping for quick profits or executing intraday trades, our real-time insights empower you to enter and exit positions with confidence and precision.

2. Comprehensive Price Projections: From stop loss & take profit levels to reversal numbers, the platform provides a comprehensive suite of price projections to support your trading strategy. With clear, actionable guidance at your fingertips, you can navigate volatile markets with ease and efficiency.

3. Aligned Trading Bias: By deriving the trading bias from the daily timeframe, the platform ensures that your trading decisions are always aligned with the broader market trends. Whether you're following the trend or looking for countertrend opportunities, our scalping system helps you stay on the right side of the market.

4. Unrivaled Asset Coverage: With access to over 125 symbols across forex, US & global indices, metals, commodities, and US bonds, the platform offers unparalleled coverage of the global markets. Diversify your portfolio, capitalize on emerging trends, and seize opportunities across multiple asset classes — all from a single, user-friendly visual interface.

Join the ranks of savvy day traders who trust our scalping system to unlock new levels of precision and profitability.

With time projection, price projection, aligned trading bias, unrivaled asset coverage, and continuous improvement,

there's no limit to what you can achieve in the markets.

Ready to elevate your trading game? Sign up with today for a 7-day free trial and experience the future of scalping firsthand

US Recession Watch

We combine macro indicators along with statistically adjusted forward-looking indicators such as time cycles, harmonics, liquidity & other aggregated risk models that provide a timely bias for market tops (and bottoms)

While other competing recession-driven models may be accurate in declaring a bear market their signal may often come after a significant decline of 20-30% in the stock market, which once this happens defeats the entire purpose for an investor to go to cash, or dare we say go short. The RecessionWATCH model on the other hand strives in providing early warning signals at market tops where it is most opportune for an investor, or even business owner to take (early) action

RECESSION & LONG TERM INVESTORS REPORTING SERVICE

Economic recessions are inevitable occurrences in any economy. They are characterized by a significant decline in economic activity, often accompanied by a decrease in consumer spending, business investment & employment.

Identifying the warning signs of a recession is crucial for individuals, businesses, and policymakers to prepare adequately and implement strategies to minimize its impact.

Our US Recession Watch service monitors a wide range of economic indicators and combines them with forward-looking analytics that identify patterns & long term trends that may indicate an impending US recession.

THE USE CASE

Our US Recession Alert Service is indispensable for various stakeholders

Individual Investors: Protect your investment portfolio by receiving timely alerts and expert analysis to adjust your investment strategy accordingly

Financial Advisors: Provide proactive guidance to your clients by staying informed about potential economic downturns and offering tailored recommendations to safeguard their financial interests.

Business Owners: Adapt your business strategy to mitigate the impact of recessions on your operations, such as adjusting inventory levels, optimizing cash flow, and diversifying revenue streams.

Economic Researchers & Portfolio Managers: Utilize our data and insights to conduct comprehensive research on economic cycles, contributing to a deeper understanding of the factors influencing economic stability.

Benefits

By subscribing to our service, you'll gain access to a range of benefits

Real-Time Email Alerts: Receive instant notifications via email whenever there are significant changes in economic indicators that may signal a US recession.

Expert Analysis via our Web Based Portal, accessible 24 hours a day 7 days a week: Benefit from in-depth analysis and insights provided by our team of financial analysts, helping you interpret the data and make informed decisions.

Long Term Reversals for Investors: Receive long term cyclical recommendations based on market conditions to help you navigate challenging economic environments effectively. For example when to go into cash or take a pause, etc

Peace of Mind: Stay ahead of economic downturns and make informed decisions with confidence, knowing that you're equipped with reliable information and guidance from industry experts.

7-DAY FREE TRIAL AVAILABLE, GIVE IT A TRY NOW

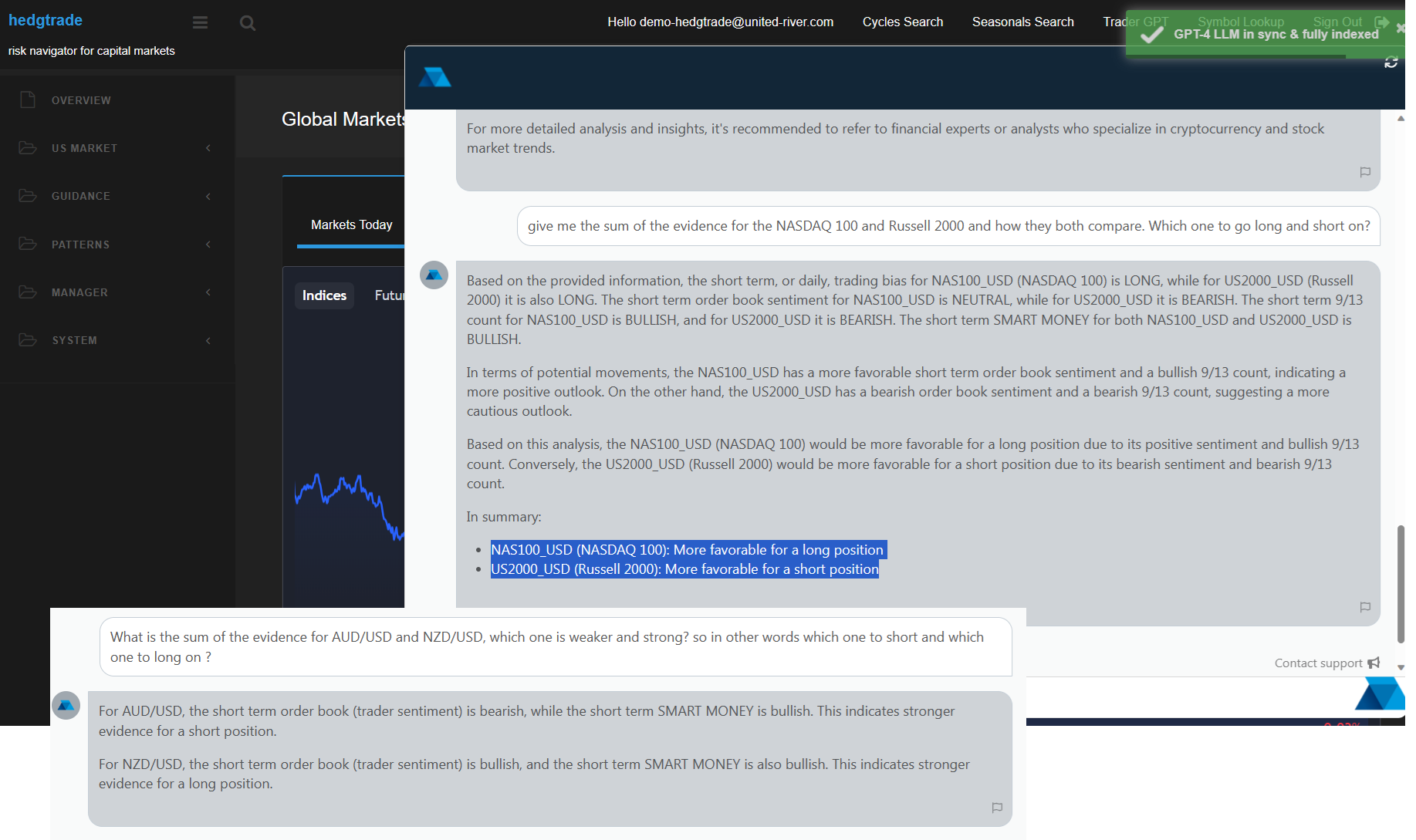

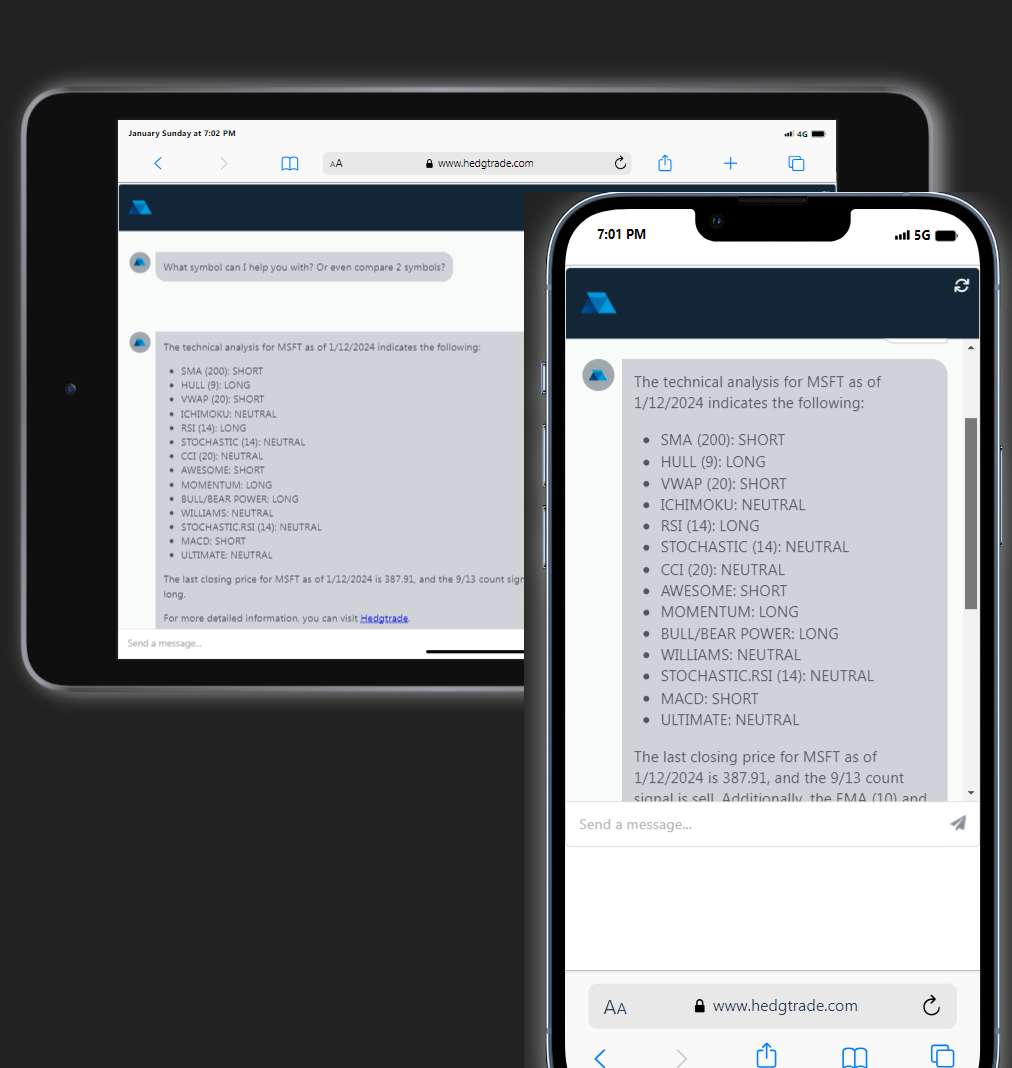

Trader GPT - Empowering Your Trading Journey

Why Trader GPT?

Trader GPT is not just a chat trading bot but also a full blown real time reporting environment that has more than 4 million lines of programming code and supports more than 2600+ instruments - forex, metals, crypto, US bonds, commodities, global indices and US stocks.

It is your strategic wingman in navigating the complexities of the global markets.

With a robust combination of machine learning, cyclical regression, and predictive analytics, Trader GPT empowers traders and investors to make informed decisions.

Key Features

Multi-Factor Cyclical & Pattern Analytics

Machine Learning for Time & Price Projection

Real-Time Insights for 2600+ Instruments

Visual Dashboards for Enhanced User Experience

Mobile App for On-the-Go Trading

Experience Unmatched Benefits with Generative AI & Machine Learning For More Than 2600+ Instruments

Increased Profitability - gain a significant edge in your investment and trading strategy

Time Saving - get essential information to make informed decisions, saving valuable time

Reduced Risk - minimize risk by avoiding underperforming investments and drawdown

Access to Proprietary Technology - utilize exclusive technology and algorithms for a competitive advantage

Increased Transparency - visual dashboards offer a clear understanding of the market

Ease of Use - user-friendly dashboards simplify complex data for informed decision-making

Subscribe Now | 7-Day trial available

Trader GPT Mobile App

Take your trading journey on the move with the Trader GPT Mobile App. Access real-time insights, predictive analytics, and market trends in the palm of your hand. Whether you're commuting or enjoying your coffee, stay connected to the market anywhere.

7-Day Trial Available

Choose a plan that suits your trading needs - available for both retail traders, and institutional investors. Unlock the full potential of Trader GPT with our flexible pricing options.

Subscribe Now | 7-Day trial availableStay Informed with Trader GPT Blog

Explore our blog for in-depth articles, market insights, and tips from industry experts. Enhance your trading knowledge with the latest updates.

Read Our Latest PostsBenefits

Traders and investors alike live in a world of probabilities not certainties

Along with the Hedgtrade quantitative platform, the monitoring of the overall directional risks becomes the job - effectively turning the manager into the business of minimizing drawdown and optimizing the opportunity from a statistical point of view

Our users have access to a machine learning and forward looking engine that helps forecast cyclicly adjusted predictions in short, mid and long term frames. Supported by a quagmire of timeseries calculations that derive detailed cyclicalities and other predictive analytics in real time, including but not

limited also to seasonal patterns, reversal points & pivots, cyclicly adjusted RSIs and option maxims series and liquidity projections among many others

The Hedgtrade quantitative platform is maintained in real time across 2600+ financial instruments,

and suffice to say it's taken the team more than 7+ years to design, code and backtest and has more than 3.8 million lines of programming code as of 2024. Our platform is a living organism and never stops growing, come join us and free trials are available to eligible participants

Key Benefits

INSIGHTS INTO MARKET TRENDS - By using a combination of cycle analysis, and other metrics such as the aggregated retail order book, you can receive valuable insights into the future trends for more than 2600 instruments across different asset classes (forex, US indices, commodities, metals, crypto, ETFs & US stocks, etc…)IMPROVED INVESTMENT DECISIONS - By having access to accurate and up-to-date information, you are better equipped to make informed investment and trading decisions

INCREASED PROFITABILITY - By using the platform’s content to inform your investment decisions, you may see an increase in your overall profitability, and less drawdown

INCREASED PEACE OF MIND - By having a deeper understanding of the market, you will be able to make more informed decisions, reducing the uncertainty and stress often associated with investing.

VISUAL EXPERIENCE - The visual dashboards offer a simple yet efficient user experience that allows for an instant understanding of the overall direction

EXPERT ANALYSIS - The analysis is performed using standard and well proven statistical and mathematical models, we have no secret or magic data to hide just a well organized and structured financial interpretation for more than 2600+ instruments, ensuring the quality and accuracy of the information provided

Hedge Funds, Family Offices / Independent AMs, HNWIs, Trading Platforms & Ohter Investment Houses

Have the Hedgtrade platform provide an additional level of comfort and confidence to what is a constant flux of stressful trading and investment decisions

For the more sophisticated

and quantitative guys out there, the Hedgtrade reporting service also includes a set of APIs that can be consumed

hence providing a seamless experience and a way to enrich your architectural automation

Free trials are available, contact us now for more detail

Ready to give it a go? We offer a 7-day risk free trial to eligible participants

Financial Advisors, WMs, and even for the well educated and seasoned retail traders & investors

The best trading and investment coaches out there will all tell us the same thing, we need a system. Only with a system can we all be more consistent and therefore profitable over time. The

Hedgtrade platform is a stable, statistically adjusted predictive model. The firm's mantra being to democratize its core risk engine, and make the world a better place by helping discerted traders and investors alike

We are keen to hear from you and see if and how we can help you and even your clients

Contact us now using the online form or by email and we will get back to you as soon as possible

Cycles & Pattterns

Cycle analysis, multi pattern seasonalities combined with other forward looking metrics can be used as a part of a comprehensive market research strategy to predict risk adjusted trends in the capital markets. However, it is important to note that the stock market is complex and influenced by many different factors, and no single model or approach can guarantee accurate predictions.

Cycle analysis involves identifying patterns and regularities in market data and using that information to forecast future trends. Seasonality (day of month, day of week, political cycle, decennial, and so on) refers to the tendency for certain market trends to occur at regular intervals throughout time, based on factors such as market behavior and historical patterns.

When all combined together, cycle analysis, seasonality and other forward looking metrics such as our aggregated retail order book model among others can provide valuable insights into the market and potential trading opportunities. Some of our most sophisticated clients also use the platform in conjunction with other forms of analysis, such as fundamental analysis, and macroeconomic analysis, to gain a more complete picture of short, mid and long term market conditions.

It is always important to have a well-defined trading plan and risk management strategy in place when using any kind of market analysis or predictive model. The stock market is inherently uncertain and subject to sudden, unpredictable changes, and it's crucial to be prepared for both positive and negative outcomes, so why not look at the Hedgtrade platform as part of your trading and investment toolkit, its difference will be felt instantly.

The Hedgtrade reporting service comes along with many different forward looking metrics and our users appreciate the ease of navigation in addition to the timely predictive analytics it provides. We do trials and also short web based product demonstrations, get in touch with the team to find out more.

Cyclicality Models Running in Real Time For 2600+ instruments

Supports more than 2600+ financial instruments, provides L/S trading bias in real time, as well as fully documented reporting dashboards that are updated non stop

Multi Asset Class & Template Driven

The platform is template driven in that any instrument can be mapped and onboarded onto the platform The following asset classes are currently supported: US indices, Major/Minor/Exotic FOREX pairs, Commodities, Metals, Crypto (Bitcoin), Treasuries/Bonds, ETF – country, ETF – sector US Stocks – DJIA constituents, US Stocks – SP500 constituents, US Stocks – Russell 2000 constituents

Forward Looking Analytics for the US Stock Market

One of the keys if not the key requirement to being successful in trading is not to look at what has happened (think "technical analysis"), but rather to look at data sets that provide a forward looking outlook. The Hedgtrade platform provides short, mid and long term forward looking projections and detailed guidance. Reach out today for a few sample screenshots and additional information, or even a short product demonstration

Efficient Design, Great Visual User Experience & API Library for Automation

Pointless to say, data sets and predictive analytics are as good as the publishing mechanism that's used to consume them. We have spent a massive amount of time in listening to our customers' feedback and ideas and thats an approach that will never change with Hedgtrade. A library of RESTful Web Services (API) is also made avaialble to those that require integration and automation, we are ourselves quite tech savvy and can help you customize any workflow you may require. Pleaae reach out and let us know your requirements

Interactive Dashboards

Machine Learning (ML) using Supervised Modelling & Cyclical Regression

Available for 2600+ instruments, combine these projections along with additional markers, included but not limited to buy/sell signal logic and various tyoes of seasonalities among others

S&P500 Sample Report

Key Advantages

- INCREASED PROFITABILITY - By using our forecasting service you gain a significant edge in your investment and trading strategy, resulting often in increased profits

- TIME SAVING - The service saves you time by providing you with the most important information you need to make informed investment decisions

- REDUCED RISK - Our predictions and analysis help you minimize risk by avoiding underperforming investments and drawdown

- ACCESS TO PROPRIETARY TECHNOLOGY - Our service utilizes proprietary technology and algorithms that are not available to the general public, providing you with a competitive advantage

- INCREASED TRANSPARENCY - Our visual dashboards provide you with a clear and transparent understanding of the market, allowing you to make informed decisions with confidence

- EASE OF USE - Our visual dashboards are user-friendly and easy to understand, making it simple again for you to make informed investment decisions

AI-driven quant research, trading & risk navigator for capital marketsⒸ

A highly visual alpha-generating and beta-neutralizing quantitative research platform for traders & investors alongside generative AI for user investigationPatterns & Analytics for more than 2600+ instruments - US & Global Indices, Forex, Commodities, Metals, Treasuries, Bitcoin, US Stocks & ETFs. Leverage the unique benefit of being able to crunch hundreds of risk metrics into a simple AI-driven Q&A environment for alpha discovery

7-Day Free Trial Available

Multi Factor Cyclical & Pattern Analytics Reporting

Generative AI & predictive analytics that cover more than 2600+ instruments across various asset classes - forex, metals, crypto, US bonds, commodities, global indices and US stocks - and helps investors accrue their alpha & minimize drawdown

Benefits Features

Trader GPT

for traders & investors Ⓒ

Powered by OpenAI's GPT-4, Trader GPT offers a large language model (LLM) chat function that allows you to ask questions & identify

opportunities in real time for 2600+ symbols - and by design with a strong focus on the US stock market

Take A Look 7-Day Trial

API for Data & Research, Pre-Trade Compliance

Seamlessly integrate Hedgtrade's cyclical & pattern analytics and even your own internal data sets alongside our GPT 4 engine.

Create a world-class AI experience and power new insights into your investment capabilities

Quantitative Research Platform for Traders & Investors

forward looking market risk analytics that bring insight & visibility as to the direction of your trading decisions

Making the Complicated Simple

Traders & investors live in a world of probabilities - not certainties

Along with the Hedgtrade quantitative platform, the monitoring of the overall directional risks becomes the job - effectively turning the manager into the business of minimizing drawdown and optimizing the opportunity from a statistical point of view

Our users have access to a machine learning and forward looking engine that helps generate cyclicly adjusted projections in short, mid and long term frames. Supported by a quagmire of timeseries calculations that derive detailed cyclicalities and other predictive analytics in real time, including but not

limited to seasonal patterns (aggregate, election, day of month, etc), reversal points & pivots, cyclicly adjusted RSIs and option maxims series and liquidity projections among many others

Product Sheet Sample Models

Multi Asset Class, 2600+ Instruments

The Hedgtrade quantitative platform is a multi factor cyclical & predictive analytics reporting solution that covers more than 2600+ instruments across various asset classes - forex, metals, crypto, US bonds, commodities, global indices and US stocks - and helps investors manage alpha & minimize drawdown

Hedgtrade is maintained in real time and suffice to say it's taken the team more than 7+ years to design, code and backtest and has more than 3.8 million lines of programming code as of 2024.

Our platform is a living organism and never stops growing, come join us and free trials are available to eligible participants

Recent News & Articles

Hubbis - Asia Wealth Management

November 2023 - Singapore Algorithmic Trading Platform Aims to Fast-Forward Wealth Managers’ Investment & Trading Capabilities

Read Article

Hubbis Investment Forum - November 2023

November 2023 - We presented Hedgtrade in front of 300+ institutional investors keeping in mind that wealth managers are long term investors, but what about hedging?

Introducing Trader GPT by HedgtradeⒸ

August 2023 - Hedgtrade has been in the market since 2018, yet an improved way to

consume its vast array of analytics is now to leverage GPT-4. Powered by OpenAI, Trader GPT offers a large language model (LLM) chat function...

JOIN US NOW

Accrue the quality and value of your trading decisions and put the stats in your favor in terms of managing drawdown and taking profits by thinking in terms of daily, weekly or even monthly projection using machine learning and forward-looking cyclical & pattern analytics. If you are a hedge fund manager, financial advisor, HNWI or a serious trader then don't let your next successful trade slip away and get in touch now

Copyright 2024 Hedgtrade - All Rights Reserved

7-Day Free Trial Available

The Hedgtrade platform is a statistically adjusted predictive model that was designed and still is used to power investment firms. The firm's mantra being to democratize its core risk engine, and make the world a better place by helping discerted traders and investors alike

Copyright 2024 Hedgtrade - All Rights Reserved

Contact Us

Drop us an email, we'd like to hear from you.

The Hedgtrade platform is a statistically adjusted predictive model solution. The firm's mantra being to democratize its core risk engine, and make the world a better place by helping discerted traders and investors alike

Copyright 2024 Hedgtrade - All Rights Reserved